A large percentage of companies will face the prospect of making an acquisition or being acquired at some point during their lifetime. There are many different reasons that could lead to an acquisition. Once you are on that path, there are a set of conditions that can help determine the likelihood of success, and help reinforce the decision, or perhaps shine a brighter light on it, for either the acquirer or the acquired. One has to start with the premise that a company is being bought, not sold. A subtle distinction, but putting a “for sale” sign up versus having at least one, preferably several buyers, knocking on your door makes a big difference. At the end of the day the company needs to be valuable in the eyes of the beholder (buyer).

During 1996-2000 I was fortunate enough to be an executive at Cisco Systems, a time period that I think will be difficult to reproduce, at least in my lifetime, although I never say never. We all know this was the bubble, but that notwithstanding, Cisco was able to grow in sales from $4B to $20B, acquire 40 companies (see the complete list here http://goo.gl/zPAMiB), grow headcount from 6,800 employees to over 45,000 employees and create over half a trillion dollars in market value. One of the acquisitions was Stratacom (Cisco Systems to Join with Stratacom http://goo.gl/LKkXm6) , a company I joined as employee #12. That was my entry point into Cisco and to what I jokingly tell people was my earning a 4 year degree in “Hyper Growth”. During this time period I witnessed Cisco acquire companies successfully at the clip of almost one per month (I acquired two myself as a VP/GM). This allowed Cisco to scale and capture market share at an unprecedented pace and establish itself as a leader in the networking space.

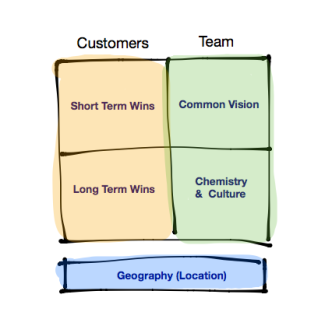

Having lived through this up close and personal, I often get asked the question “how did Cisco do this and what was their formula for success”?. The chart below shows the four key ingredients that help determine both the potential value of a combination and also the probability of success. Not surprising the two main themes center around (1) customers, and (2) teams. The fifth ingredient is a consideration that can either enhance or detract from the value of the combination, but typically will not materially affect the outcome.

Short term wins: Both companies need to have a clear path to winning several customers in the first 90 days post merger. Customers are the lifeblood of success and winning. Making this visible to the organization is critical in the early days of a combination. It also creates focus around sales and marketing and what it takes to win. It reinforces the decision that the combination was the right thing to do. It is a simple exercise: each company looks at each other’s pipeline, looks at the competition and determines that working together they can disrupt the market place and win deals they otherwise would not have been able to do as independent companies.

Long term wins: This is all about market share. Can the combined companies capture market share that is larger than the sum of their own shares and create a product portfolio that has sustainable competitive advantage. It’s the old saying of “1+1 is greater than 3” (at least). This requires the marketing teams to look beyond the first 90 days and see a roadmap that creates market share leadership in the long term.

Common Vision: Having alignment on what the future of the combined entity looks like and the impact they they want to have on the industry is critically important. It is also difficult to measure or to calibrate and the the results will only be apparent over time, which of course may be too late. The leaders of both companies will need to determine if this alignment can be achieved and understand the risks if they are not. It certainly is best to start with a tightly aligned common vision since there will undoubtedly be challenges along the way that might throw things of course.

Culture & chemistry: One of the key ingredients of building high performing successful teams and also one of the most difficult things to test for and achieve. We used to lock management teams together for a day as part of the diligence process and let them work through the short term wins, long term wins, and common vision. That exercise alone helped everyone figure out if the personal chemistry existed (and more importantly if it was blatantly negative). At the end of the day it is a marriage of sorts. This is a category where you look for sufficient positive signs and then hope for the best but know that the proof will come once the teams are combined and executing together. “There’s an excellent fit of cultures, values and personal chemistry” would be good way to start, which is the quote Dick Moley gave in the press release when Cisco acquired Stratacom.

Geography: This is not typically a deciding factor, but it can be a positive if the combination creates locations that are desirable from a company expansion standpoint, either in terms of presence for customers, or to provide access to additional pools of talent to scale the company. On the flip side if the combination is a “merger of equals” being geographically apart or disperse can become a significant drag to achieving the short term wins, long term wins, common vision, and culture & chemistry. Large company mergers of equals in disparate geographies have never succeeded; at least I can’t point to one.

Whether you are acquiring or being acquired, I think the above should provide a template to help gauge how valuable the combination might be and the chances for success. There are obviously many other factors, but I would argue that if you cannot score highly in these categories at least from the onset, that the path down the road will likely be very challenging. There are never any guarantees, but this playbook has been tested repeatedly and with positive results. Just another set of of management tools to consider.

Good day I am so excited I found your weblog, I really found you by mistake,

while I was researching on Digg for something else, Anyways I am here now

and would just like to say thanks for a fantastic post and a all round entertaining blog (I also love the theme/design), I

don’t have time to go through it all at the minute but I have saved it and

also added in your RSS feeds, so when I have time I will be back

to read much more, Please do keep up the superb b.

LikeLike